60+ banks lost money during the mortgage default crisis because

Web 1 day agoThe biggest US. Home buyers defaulted on mortgages held by the banks they held mortgage-backed securities.

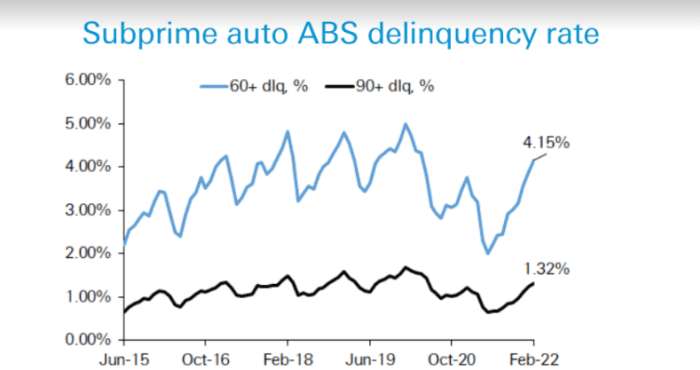

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

Web The subprime mortgage crisis was also caused by deregulation.

. Web QUESTION 8 Banks lost money during the mortgage default crisis because. There are 108 banks in the Russell 3000 Index RUA -170 that had total assets of at least 100. Web 2 days agoStarting with a list of US.

9 The FDIC ramped up staff in preparation for hundreds of bank failures caused by the mortgage crisis and. Web When increasing numbers of US. Treasuries and mortgage-backed securities that it had invested in owing to.

Web Banks with the highest percentage of negative AOCI to capital. Banks with total assets of at least 10 billion and removing purer investment banks such as Goldman Sachs Group Inc. Web Question 14 1 1 pts Banks lost money during the mortgage default crisis because from BUS MISC at Edison State Community College.

Of defaulted loans to investors in the mortgage-backed securitiesb. Banks lost money on the loans and so did banks in other countries. 03272020 0452 PM EDT.

- of defaulted loans to investors in mortgage-backed securities. Banks are much stronger than they were in the lead up to the last big banking crisis in 2008 in part because regulators forced them to hold more. Web 1 day agoBecause major banks had extensive exposure to one another the crisis led to a cascading breakdown in the global financial system putting millions out of work.

Web By the end of the day SVB shares had fallen by 60. Web Bank weakness and fear caused bank failures. Web banks lost money during the mortgage default crisis becausea.

On Friday morning CNBC reported that SVB had been unable to raise the cash it had been hoping to assemble. 3 They also invested depositors funds. They held a mortgage-backed.

Web were community banks often in parts of the country where the subprime mortgage crisis and the recession made real estate problems more severe than elsewhere. Web 1 day agoWhether depositors with more than 250000 ultimately get all their money back will be determined by the amount of money the regulator gets as it sells Silicon Valley. Web 1 day agoTo quickly revisit this whole mess Silicon Valley Bank lost 18 billion in the sale of US.

In 1999 the banks were allowed to act like hedge funds. Web 1 day agoMarch 10 2023 732 AM 4 min read. Consumers defaulted on their mortgage loans US.

Web Banks lost money during the mortgage default crisis because. Mortgage finance system could collapse if the Federal Reserve doesnt step in with emergency loans to offset a. - they held mortgage-backed securities they.

Treasury Secretary Janet Yellen said there are a few banks the department is closely watching as a crisis at Silicon Valley.

Era Of Stimulus Distorted Consumer Credit Ends Auto Loans Delinquencies Prime Subprime Wolf Street

Alt A Option Arm And Subprime Loans Will Turn California Into A Zombie Mortgage State 28 Percent Of Alt A Loans In California 60 Days Late Alt A Mortgages By California Region 1 1 Million Alt A

How 60 Startups Are Disrupting Retail And Commercial Banking Around The World

Conference Magazine Deutsches Eigenkapitalforum

Subprime Auto Loan Delinquencies Rise To 2019 Levels A Dive Into Subprime Lending And Securitizations Wolf Street

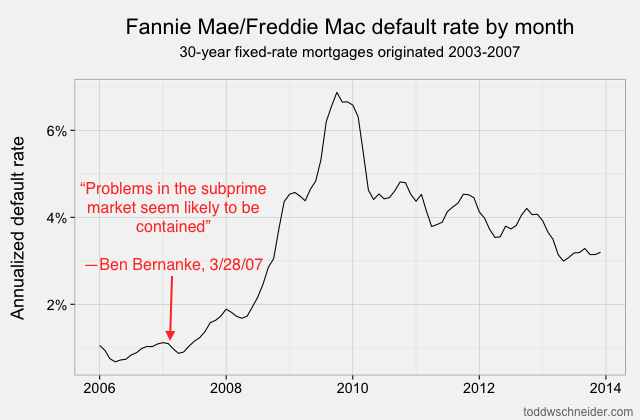

Mortgages Are About Math Open Source Loan Level Analysis Of Fannie And Freddie Todd W Schneider

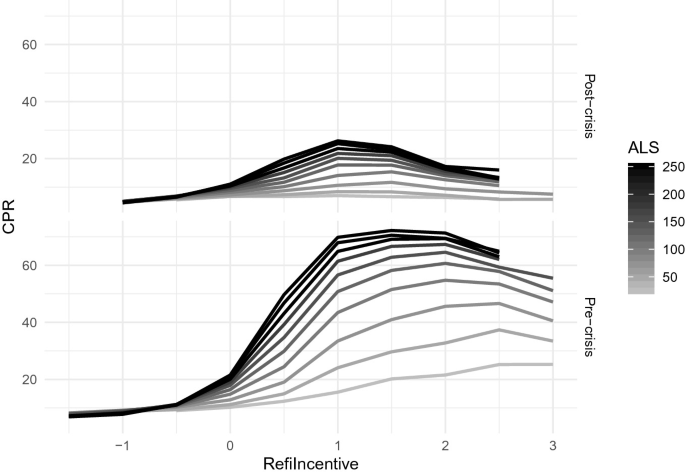

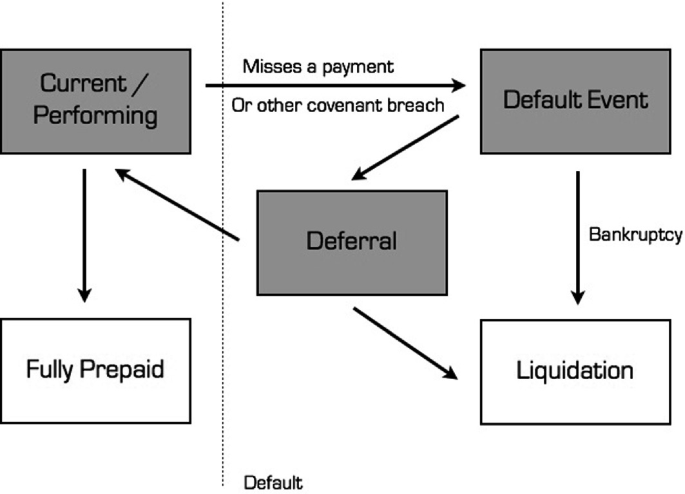

Pdf Estimating Default Probabilities Of Cmbs Loans With Clustering And Heavy Censoring

Pdf Strategic Defaults On First And Second Lien Mortgages During The Financial Crisis Julapa Jagtiani Academia Edu

Non Monetary Indicators To Monitor Sdg Targets 1 2 And 1 4 Standards Availability Comparability And Quality

Overview Of Loan Portfolio Analysis Springerlink

How 60 Startups Are Disrupting Retail And Commercial Banking Around The World

Era Of Stimulus Distorted Consumer Credit Ends Auto Loans Delinquencies Prime Subprime Wolf Street

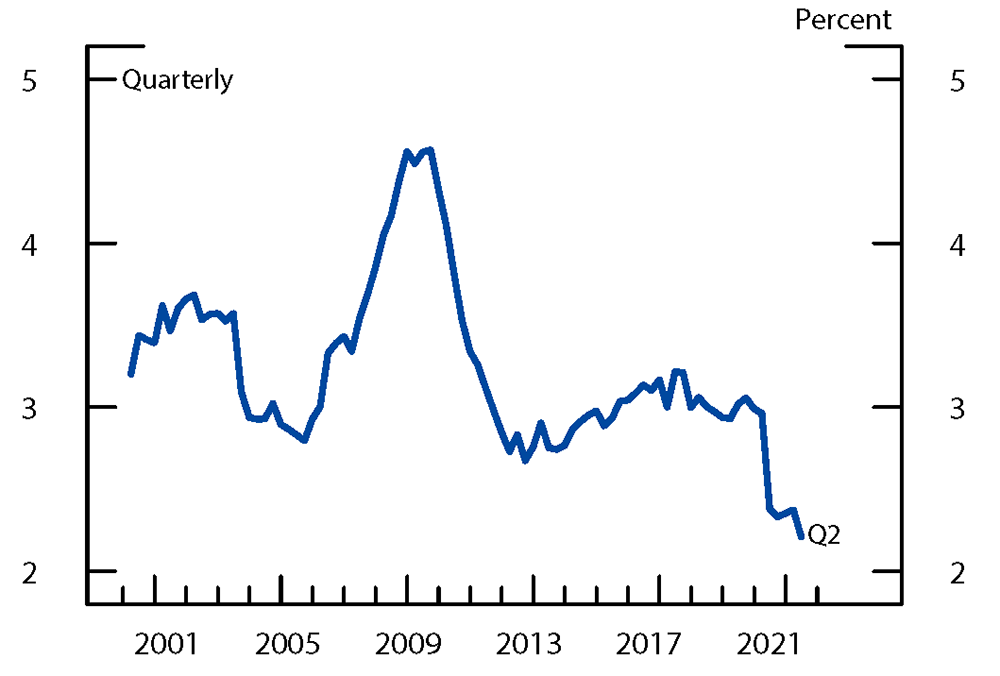

The Fed Delinquency Rates And The Missing Originations In The Auto Loan Market

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

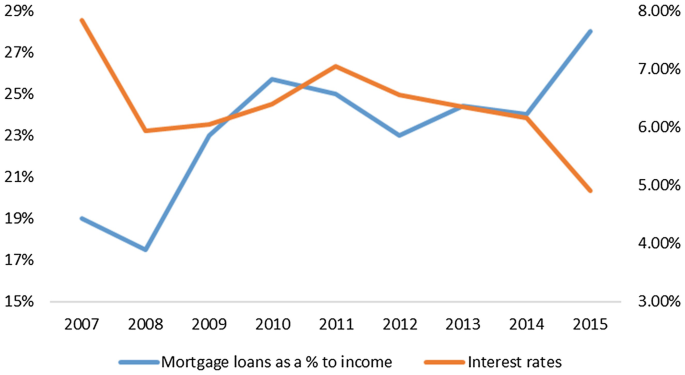

Housing Financing At The Crossroads Access And Affordability In An Aging Society Springerlink

Overview Of Loan Portfolio Analysis Springerlink

Past Due Subprime Auto Loans Climb To Highest Rate Since April 2020 A Potential Sign Of Trouble Marketwatch