40+ where does mortgage interest go on 1040

You received interest from a seller-financed mortgage. Web Use Schedule B Form 1040 if any of the following applies.

Tpo Non Agency Products Credit Reporting Qc Home Insurance Fee Collection Tools Mortgage Apps Skyrocket

From the left sections select Interest.

. Tap the F6 key to go to the Open Forms window. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Web The business portion of your home mortgage interest allowed as a deduction this year will be included in the business use of the home deduction you report on Schedule C Form.

Web Go to Screen 25Itemized Deductions. 13 1987 your mortgage interest is fully tax deductible without limits. Beginning in 2018 the limitation for the amount of home.

File Now Get Your Max Refund. Ad File Your 1040 Form Online With Americas Leader In Taxes. The total of your itemized deductions which includes your deductible mortgage interest is found on line.

Web Where do you find mortgage interest on a 1040 Form. Field enter D H and M to find Ded Home Mort in the. Web If you took out your mortgage on or before Oct.

Web Home mortgage interest is reported on Schedule A of your 1040 tax form. In the Home mortgage interest points on Form 1098 A CtrlEfield hold down Ctrl and press E. Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest.

Web Mortgage Interest Credit. Web Open your clients Form 1040 return. Web When you have a seller financed mortgage you must file Schedule B regardless of your total interest income.

Web Up to 96 cash back On your 1098 tax form is the following information. Web Schedule A Form 1040 - Home Mortgage Interest. Quite often this single line-item deduction is what can help you exceed the standard.

Total your interest income for the year and report it on line 4 of. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. No Tax Knowledge Needed.

You had over 1500 of taxable interest or ordinary dividends. Web When claiming the mortgage interest credit amounts entered in this statement will transfer to Form 8396 line 1. The portion of the amount shown on Form 8396 line 3 that is.

You can only deduct interest on the first 375000 of your mortgage if you bought your home after December 15 2017. Also if your mortgage balance is 750000. Web All reported mortgage interest will be entered on line 8a any unreported will go on line 8b and mortgage insurance premiums will go on line 8d.

TurboTax Makes It Easy To Get Your 1040 Forms Done Right. Web When you fill out your Form 1040 tax return report your total itemized deductions on line 40 instead of writing your standard deduction on this line. Web If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction.

Box 1 Interest paid not including points Box 2 Outstanding mortgage principle Box 3 Mortgage origination. Web Up to 96 cash back If part of your home is used as a home office then that portion must be allocated as a business expense and isnt eligible for a home mortgage interest deduction on. You may be able to take a credit against your federal income tax for certain mortgage interest if a mortgage credit certificate MCC.

Form 1098 Mortgage Interest Statement Community Tax

The Home Mortgage Interest Deduction Lendingtree

Homeowners Mortgage Interest Real Estate Taxes Are Deductible Hgtv

Mortgage Interest Tax Deduction What You Need To Know

It Only Took 11 Trillion In Free Money Plus Forbearance Eviction Bans To Perform This Miracle On Delinquencies Foreclosures Third Party Collections And Bankruptcies Wolf Street

Understanding Taxes Interest Income

Checklist Essential Mortgage Documents Hgtv

Louisiana State Income Tax Filing Begins Today New Orleans Citybusiness

681 County Road 254 Georgetown Tx 78633 Mls 48570320 Zillow

Why The Ideal Income Is The Student Loan Forgiveness Income Threshold

Kaiserslautern American January 15 2021 By Advantipro Gmbh Issuu

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Interest Income Ef Messages 5378 And 5285

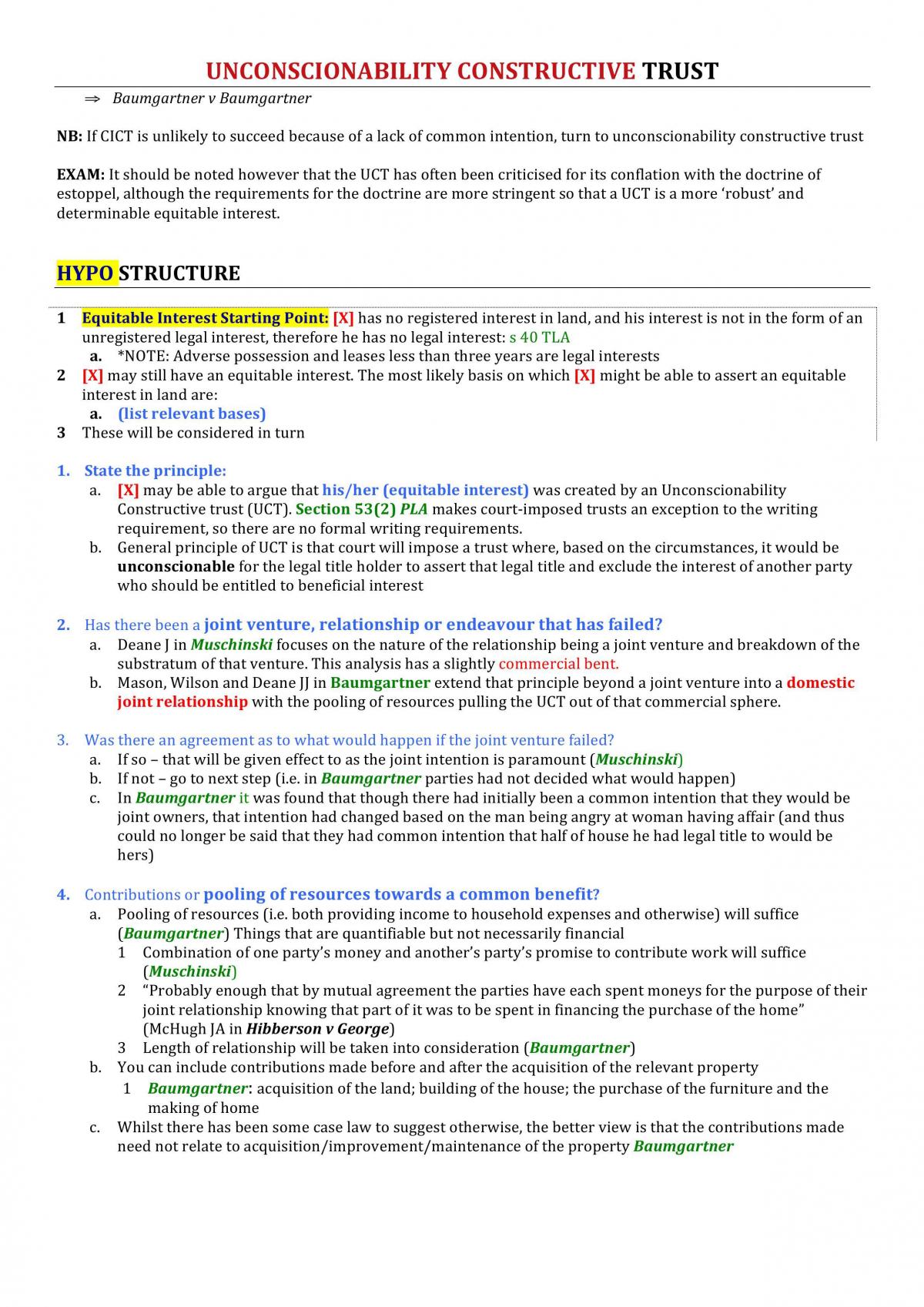

Creation Of Equitable And Lesser Interests In Land Laws50030 Property Unimelb Thinkswap

Mortgage Interest Deduction A Guide Rocket Mortgage

Home Mortgage Loan Interest Payments Points Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget